Congrats, you are a landlord! Now comes the fun part. Finding a tenant. Or, more accurately, hopefully not finding the wrong one. Because here’s the thing: A bad tenant can mess up your finances, your peace of mind, and occasionally your will to continue being a landlord at all. So, what does a “bad tenant” actually cost you?

Let’s dig in. Not in a scary spreadsheet way. Just the honest, back-of-the-napkin kind.

1. Unpaid Rent

Let’s start with the obvious. According to a 2023 survey by Avail (a part of Realtor.com), about 15% of landlords reported missed rent payments in a typical month. That’s not rare. That’s Tuesday.

If your tenant stops paying, you’re suddenly eating the mortgage, utilities (if you cover any), and property taxes. For a median-priced rental property, missing even two months of rent could cost you upwards of $3,000, and that’s before legal fees if things go south.

2. Property Damage

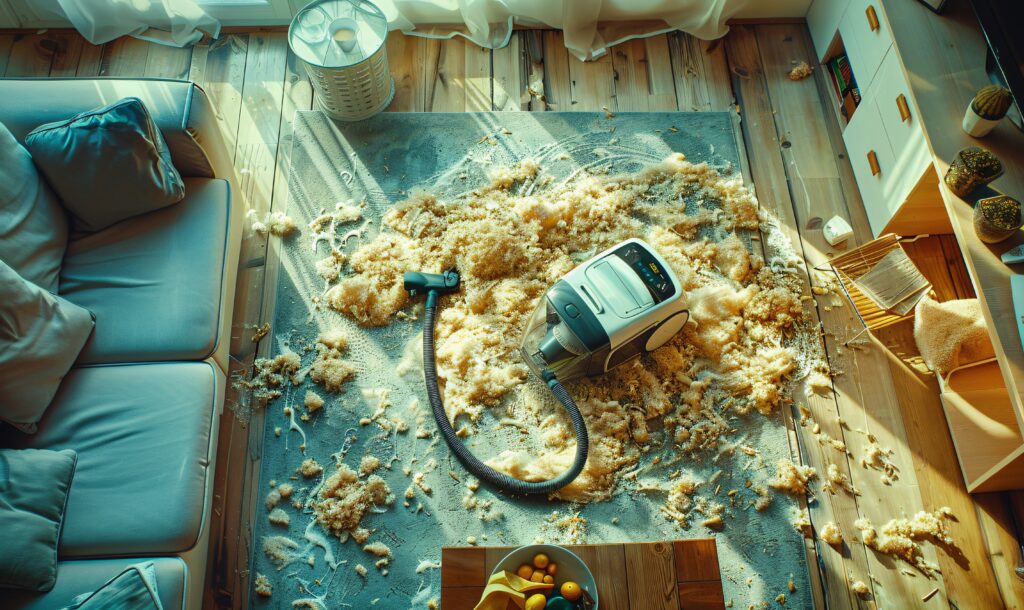

We’re not talking a nail in the wall or a scuff on the floor. We’re talking holes. Mold. Doors kicked off hinges. Sometimes… things you really don’t want to describe out loud.

Replacing carpets, repainting, fixing plumbing disasters, it adds up fast. According to the National Association of Residential Property Managers (NARPM), landlords spend an average of $2,500 to repair damage left by problematic tenants.

And that’s assuming you can even re-rent the place right away. Which brings us to…

3. Vacancy Costs

Every day your place sits empty, you’re not just losing rent. You might be paying for utilities, yard maintenance, or even HOA fees. You also might need to lower the rent to attract someone quickly.

It’s like a silent leak in your bank account. No drama. Just drip… drip… drip.

Evictions Are a Special Kind of Nightmare

Ah, the “E” word. No one wants to talk about it until it’s too late. But it happens.

Evictions aren’t cheap. Between legal fees, court filings, process servers, and possibly hiring a locksmith (yes, really), the average eviction can cost landlords between $3,500 and $10,000, depending on your state.

Not to mention the time. Evictions take an average of 3-4 weeks, and in some places, closer to three months. All while you’re not getting rent and still paying out of pocket to keep the place habitable.

And even if you “win” in court? Collecting from a former tenant is its own slow-motion tragedy.

How Does a Good Property Manager Fit Into This?

Okay, here’s the twist. You might be thinking, “I’ll just do better tenant screening next time.” And yeah. That’s part of it.

But here’s what a solid property manager brings to the table:

Better Screening Tools

They’ve seen hundreds, sometimes thousands, of applications. They know how to spot the red flags hiding behind decent credit scores. It’s not just about income. It’s about patterns.

Experience with Conflict

When things get tense, they’re not operating from a place of emotion. They handle issues with systems and legal knowledge. That’s their job. You don’t have to be the bad guy (or the frazzled one).

Prevention as a Strategy

Good property managers don’t just react. They prevent. Routine inspections, solid lease agreements, and policies that protect you before things go wrong. Like a slightly obsessive friend who triple-checks that the stove is off, annoying until they save your house.

Honestly, the cost of hiring a property manager often feels like a lot until you compare it to the cost of not having one.

A Quick Anecdote

There was a tenant who paid late every single month. Not wildly late. Just enough to keep things interesting. It felt like a personality quirk until she stopped paying entirely and ghosted.

By the time the landlord regained access to the unit, the place looked like a raccoon had been living rent-free (and possibly throwing parties). It cost him five grand to clean up and fix everything.

Now? He pays a property manager 8% of the monthly rent. And sleeps like a baby. A well-rested, rent-collecting baby.

It’s Not About Being Paranoid. It’s About Being Prepared.

To be clear, most tenants are fine. Some are downright lovely. But it only takes one bad one to throw your whole rental plan into chaos.

So, if you’re thinking of managing a property solo, just know what you’re signing up for. Be thorough. Be cautious. And, if you’re tired of worrying whether your next tenant is a nightmare in disguise, maybe, just maybe, let a professional help.

Wurth Property Management has been around this block a few times. We know how to spot the signs, dodge the traps, and keep your rental property running like a well-oiled (rent-generating) machine.