For a long time, rental success was measured in a very simple way.

Raise the rent. Keep up with the market. Repeat.

That mindset worked when demand felt endless and vacancy was an inconvenience, not a risk. But as the Gulf South rental market heads into 2026, that logic is starting to show cracks. Not dramatic ones. Subtle ones. The kind that only show up when owners look back and realize something felt harder than it used to.

Tenant retention is becoming one of those quiet factors that doesn’t make headlines but changes outcomes. Not because rent growth is suddenly irrelevant, but because it no longer does all the heavy lifting on its own.

Rent Growth Still Matters, Just Not in the Same Way

Let’s be clear. Rent growth is not going away.

Properties still need to keep pace with expenses, taxes, insurance, and maintenance costs. Ignoring rent adjustments altogether creates its own set of problems. But what’s shifting is how much pressure rent growth can realistically carry before something else gives.

In many Gulf South markets, tenants have become more informed, more selective, and in some cases, more mobile. Even when they accept rent increases, they are paying closer attention to what they get in return.

That’s where retention quietly enters the conversation.

A property can technically grow rent and still underperform if turnover accelerates alongside it. Vacancy gaps stretch. Marketing costs creep up. Maintenance gets rushed between move-outs. None of that shows up neatly in a rent increase percentage.

This is why tenant retention trends in 2026 are becoming harder to ignore. They affect cash flow indirectly, which often makes them easier to underestimate.

Turnover Costs Are Rarely Fully Counted

Most landlords know turnover costs exist. Fewer track them accurately.

There’s the obvious stuff. Cleaning. Painting. Advertising. Leasing fees. Then there’s everything else. Lost rent during vacancy. Time spent coordinating repairs. Delays caused by scheduling issues. The mental bandwidth it takes to manage another transition.

When turnover happens once in a while, these costs feel manageable. When it happens repeatedly, they start to stack in ways that don’t always show up in annual summaries.

This is where retention quietly becomes a financial strategy rather than a feel-good concept. Keeping a solid tenant for another year often protects income more effectively than pushing rent to the edge of what the market will tolerate.

Articles discussing how to stop unnecessary tenant turnover often highlight this pattern. The financial difference between a retained tenant and a replaced one is usually larger than it appears on paper.

Tenant Expectations Are Narrowing, Not Expanding

There’s a common assumption that tenants are asking for more and more. In reality, expectations are narrowing.

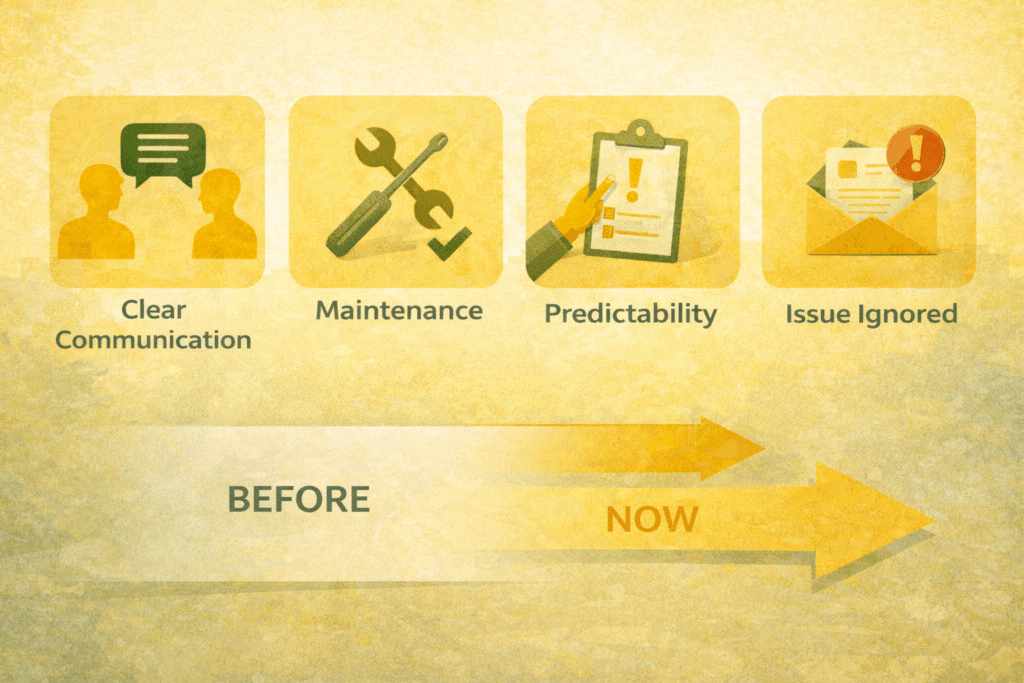

Most renters are not looking for luxury. They’re looking for predictability. Clear communication. Maintenance that doesn’t require multiple follow-ups. A sense that issues won’t be ignored.

When those basics are met consistently, rent increases feel more acceptable. When they aren’t, even modest increases can become deal-breakers.

This shift explains why properties with similar pricing perform differently in the same neighborhood. Retention is often less about amenities and more about experience. That experience is built slowly, through dozens of small interactions that don’t feel important in isolation.

The idea comes up often in discussions around reducing tenant churn. Retention is rarely lost over one big mistake. It’s usually lost through accumulated friction.

Rent Growth Without Retention Increases Risk Exposure

Higher turnover doesn’t just affect income. It increases risk.

More move-outs mean more screening decisions. More leases executed. More opportunities for documentation gaps or inconsistent enforcement. Even well-run operations feel the strain when volume increases unexpectedly.

This is one reason experienced property managers tend to emphasize retention alongside pricing strategy. Fewer transitions create more stability, not just financially but operationally.

When owners review eviction history, screening outcomes, or compliance issues, patterns often correlate with frequent turnover. Retention reduces exposure by reducing repetition.

This risk angle tends to get overlooked when the focus stays locked on rent growth alone.

2026 Will Reward Stability More Than Aggression

Markets don’t usually announce when they’re shifting. They just behave differently.

In 2026, Gulf South landlords are likely to see continued demand, but also continued sensitivity. Insurance costs, maintenance pricing, and climate-related concerns aren’t going away. Tenants are absorbing some of that pressure indirectly, and their tolerance has limits.

Aggressive rent growth strategies that worked a few years ago may still work in select cases. But across portfolios, stability is becoming more valuable than squeezing out every possible dollar per unit.

This doesn’t mean freezing rents. It means being intentional. Understanding when a renewal at slightly below maximum market rent creates better long-term outcomes than a vacancy followed by a reset.

Discussions around rental market pressure and tenant leverage touch on this dynamic often. Retention becomes a way to smooth volatility rather than chase peaks.

Retention Is Built Before Renewal Conversations Start

One of the biggest misconceptions about tenant retention is timing.

Retention is not decided at renewal. It’s decided months earlier. Sometimes in the first few weeks of a lease. Sometimes during the first maintenance request. Sometimes during the first issue that doesn’t get handled smoothly.

By the time a renewal notice goes out, tenants usually already know how they feel.

This is why retention-focused operations look boring from the outside. Systems. Processes. Documentation. Follow-through. None of it is flashy. All of it compounds.

Property managers who prioritize retention often do so quietly, by standardizing communication and reducing inconsistency. The result isn’t dramatic loyalty. It’s fewer surprises.

Rent Growth Works Best When It Has Support

The most successful rent increases tend to happen when tenants feel the property is being managed, not just priced.

That support shows up in maintenance planning, transparent communication, and predictable enforcement of policies. It also shows up in how renewal conversations are framed, not as demands but as part of a longer-term relationship.

This is where professional property managers often help bridge the gap. Not by avoiding rent increases, but by aligning them with tenant experience so they feel justified rather than abrupt.

The outcome is not universal acceptance. Some tenants will always move. But the proportion changes, and that proportion matters.

What Landlords Can Review Before 2026 Starts

Before heading into the new year, it helps to review a few retention-related indicators:

- Average tenant length of stay

- Reasons given for non-renewal

- Maintenance response consistency

- Communication gaps reported by tenants

These details often reveal more than rent comparisons alone.

They also inform whether growth strategies should lean toward pricing adjustments, experience improvements, or operational fixes. In many cases, the answer is a mix.

A Quieter Advantage Going Forward

Tenant retention doesn’t generate buzz. It doesn’t make for dramatic charts. But in 2026, it’s likely to be one of the quieter advantages separating stable portfolios from stressful ones.

Rent growth still matters. It just works best when it’s supported by systems that keep good tenants in place.

For owners who want help building that balance, working with experienced property managers can bring structure to what often feels intangible. At Wurth Property Management, we work with Gulf South landlords to focus on stability, clarity, and long-term performance. If retention has started to feel more complicated than it used to, we’re always open to a conversation about how to make it simpler going forward.

FAQs

1. Is tenant retention more important than raising rent in 2026?

A: Not always, but retention often protects income more reliably than aggressive rent growth.

2. How does turnover impact rental profitability?

A: Turnover increases vacancy, maintenance, marketing costs, and operational risk.

3. Why are tenants more sensitive to rent increases now?

A: Tenants are more informed and expect consistent service and communication in return.

4. Can rent growth and retention work together?

A: Yes. Rent growth is most effective when supported by strong tenant experience.

5. How can landlords improve tenant retention?

A: By reducing friction, improving communication, and maintaining consistent property standards.